Cryptocurrencies and marijuana both exist in a gray area in the United States. Although medically legal in 29 states and recreationally in 9, marijuana businesses have some serious limitations. The biggest hurdle to overcome is the banking system, something cryptocurrencies do better than anything else.

Market analysts like the Brightfield Group estimate that the current marijuana industry is worth about $7.7 billion. They also project it to grow to $31.4 billion by 2021. But the legal status of weed prevents that money from flowing through traditional banking channels.

Without access to banking, the industry is forced to struggle getting the investments they need to survive. Without access to investors, small businesses like dispensaries can’t get the money they need to survive financial storms. So many cannabis companies embrace cryptocurrencies as a safer alternative to keeping everything in cash.

Investing in either market is tricky

According to experts like Jim Cramer , host of “Mad Money”, investing in cryptocurrencies and marijuana is equally speculative. In an interview with CNBC Cramer said “As far as I’m concerned, there’s way too much speculation in this sector already.” His main concern is the volatility of these emerging markets.

While marijuana is dealing with an Attorney General that ignores evidence and actively despises the community, cryptocurrencies have a massive bubble growing. Investors rightly fear putting their money into a market that is likely to see massive changes in the near future. The biggest turn off for cannabis is the lack of any guarantees and the significant risk involved.

Over inflated stocks are less of an issue than looming action from the federal government. Something both industries are dealing with but is especially problematic for cannabis. The problem stems from the fact that cannabis is still federally illegal.

The government can choose to take action at any moment

There are only around 500 independent banks that work with cannabis businesses. None of the major names will go anywhere near it as it stands. So thousands of businesses across the nation are unable to accept credit or debit cards.

This creates significant problems for customers, investors and businesses. It increases the likelihood of crime, corruption and introduces human error into every transaction. So many of these businesses are turning to cryptocurrencies which bypass many of the risks of cash.

“Cryptocurrencies and the marijuana industry have a natural intersection,” according to Bryan Meltzer, a partner at the Feuerstein Kulick law firm. He specializes in cannabis clients and was featured on CNBC’s Annie Nova. He explained that using Bitcoin allows operators to avoid having cash on hand while adding a level of transparency to transactions.

Because cryptocurrencies run on blockchain tech, they are an incorruptible digital ledger. They keep records public and ensure every transaction is transparent, legitimate and theft-proof. As more companies embrace the change, it pressures others in the industry to adapt or lose out.

There is still a long way to go

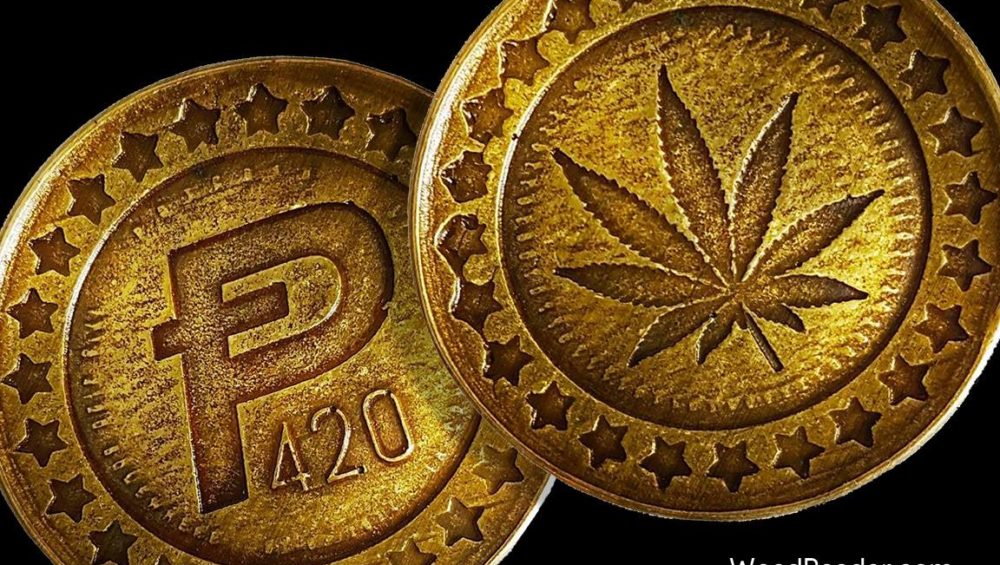

We are still in the early days of both cryptocurrency and marijuana. Although many dispensaries are turning to Bitcoin and other cryptocurrencies, most of the industry is wary. Besides that, several specialized cryptocurrencies like PotCoin and HempCoin divide the market and prevent a single currency from becoming the defacto choice.

Some experts believe the cannabis industry will lead the country to fully embrace cryptocurrencies but it’s too early to tell. If chronic and crypto do become bosom buddies, other industries are sure to follow. If the government cracks down on either or both cryptocurrency and marijuana, it will cost some investors a pretty penny.

Do you use cryptocurrencies to pay for marijuana? What do you think about the future of blockchain payments? What would you do if dispensaries only took cryptocurrency? Let us know your thoughts down below!